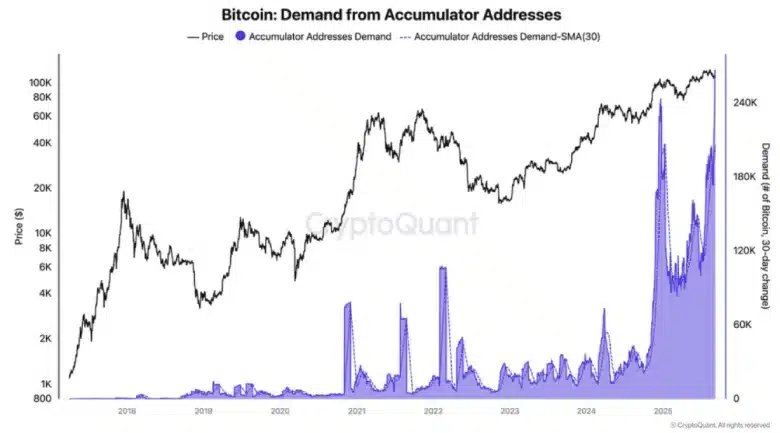

Bitcoin Accumulators Reach 266K BTC as Bullish Breakout Looms

- BTC holdings from the accumulators’ addresses hit a new high of 266,000, signaling a move from these holders despite market uncertainty.

- Bitcoin price could reverse the current correction with a bullish breakout from the inverted head and shoulder pattern.

- The momentum indicator RSI (Relative Strength Index), wavering at 50%, indicates a neutral stance among investors.

The pioneer cryptocurrency Bitcoin fell by over 0.7% during Tuesday’s U.S. market hours, continuing its consolidation trend below $113,200. The pullback came as a lack of initiation from buyers, following the rise in FUD around the September interest rate cut. However, the on-chain data highlights that BTC accumulators are continuing to build their position, signaling a strong conviction from long-term holders, thus bringing price stability. Will the Bitcoin price reclaim $120,000?

BTC Accumulator Addresses Reach Record Levels Amid Market Uncertainty

The last few weeks have seen sentiment in the cryptocurrency market take a significant twist. Many traders are increasingly convinced that Bitcoin might go back to the levels below $100,000, Ethereum will fall below $3,500, and altcoins are heading to a wide-scale correction. This sense of caution has enhanced a pessimistic wave, yet it is recorded that markets tend to swing in the opposite direction to what is expected.

While the short-term sentiment has been cooling, data concerning the ownership patterns of BTC tells a different story. A special type of wallet called the accumulator address has kept positioning at an all-time record rate. Taken together as of September 5, the aggregate of these addresses is over 266,000 BTC, the largest amount on record.

What makes these wallets interesting is not their size but rather their behavior: they have acquired Bitcoin in at least two material value transactions and have never sold any part of their holdings. This renders them a good proxy of long-term belief in the asset. In contrast to traders who buy and sell coins in response to day-to-day changes in prices, accumulator addresses indicate an intention to hold coins in place, possibly for years.

The gradual growth of their balances is timely because Bitcoin is taking root in corporate balance sheets and is being considered more broadly as a measure against macroeconomic risks. The accumulator holdings record is a positive indication that this thesis is being put into effect in practice, despite the larger market narrative continuing to be obsessed with the risk of corrections.

In historical terms, spells of great skepticism all too often coincide with a lag of accumulation, which subsequently forms the basis of recovery rallies.

Bitcoin Price Set For Bullish Rebound With This Pattern

Over the past two weeks, the Bitcoin price has been wavering in a narrow range between two horizontal levels of $113,452 and $107,472. This consolidation shows a series of bodied neutral candles with long rejection wicks, indicating a lack of initiation from buyers or sellers.

However, a deeper analysis of this 4-hour chart shows the lateral trend has developed into an inverted head-and-shoulder pattern. The chart setup is commonly spotted in major market downtrends, as it reflects a renewed bullish sentiment among investors.

By press time, the Bitcoin price trades at $111,500, positioned just 1.5% short of challenging the pattern’s neckline resistance. A bullish breakout from this resistance would accelerate the buying pressure and bolster the price to breach the next significant resistance of 117,350 before leaping for a new high.

On the contrary, if the coin price faces continued selling pressure at the $113,300 mark, the sellers could attempt another breakdown below $107,500 to hit the next significant support at $103,140 and $98,240.

Also Read: Institutional Capital Moves Into Ethereum as Spot ETFs Grow; $5k Close?