Bitcoin Price Below 365-Day MA Echoes 2022 Bear Market Signal

- The Bitcoin price breakdown below the 365-day EMA slope signals a major market shift, similar to the one that triggered the 2022 bear market.

- CryptoQuant’s Traders’ Realized Price Bands metric warns that failure to reclaim the $100K band could push Bitcoin toward $72K within 1–2 months.

- With today’s rebound, the BTC price accentuates a fake breakdown from the bottom trendline of an expanding channel pattern, suitable for a potential rebound ahead.

On Wednesday, November 5th, the Bitcoin price rebounded from the $100,000 psychological support with a 2.76% intraday gain to trade at $104,312. This upswing is currently considered a relief rally after a sharp sell-off earlier this week. The technical chart shows the falling price is teasing a breakdown below a critical support, which acted as the last line of defense before the 2022 bear market. Is the current correction a cooling breath before a new macro leg, or does it start a major downtrend?

Bitcoin Drops Under $106K as On-Chain Data Shows Correction

Over the past week, the Bitcoin price showed a notable correction from $116,381 to $98,943, accounting for nearly a 15% loss before a short rebound. This pullback can be attributed to dampened investor sentiment due to hawkish comments from Fed Chair Jerome Powell regarding the December interest rate decision, ETF outflows, long-term holder selling, cascading liquidations, and technical breakdowns.

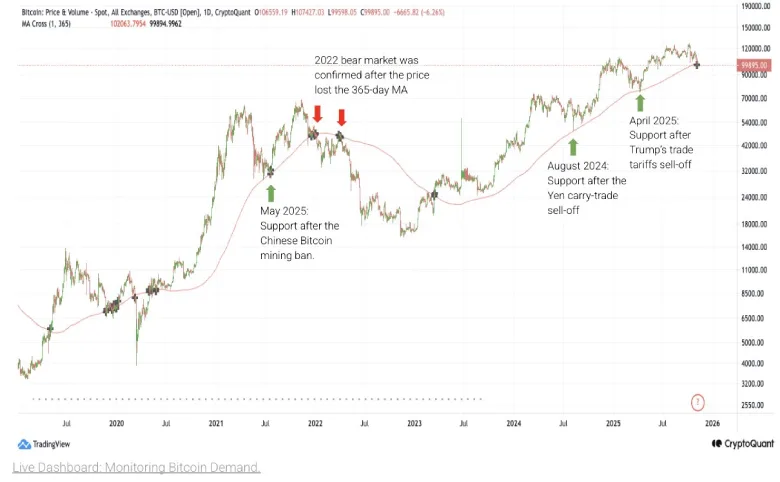

Along with a breakdown attempt from $100,000 support, the Bitcoin price also plunged below the 365-day moving average, a key technical and psychological support level. Historically, such breakdowns have indicated significant market pivots—the 2022 bear market, for example, commenced with Bitcoin losing this same EMA.

In recent cycles, the 365-day MA has proven to be a solid trend indicator, offering robust rebounds during specific events such as the August 2024 Yen carry-trade sell-off and the April 2025 trade tariff dip. However, the most recent move below this line is indicative of increasing downside pressure and a possible change in market sentiment.

If the price of Bitcoin fails to reclaim and hold above the 365-day moving average in the near future, the coin could enter a medium to long term bearish reversal like that of 2022.

In a recent analysis, CryptoQuant points outa strong confluence between the 365 MA breakdown and their Traders’ Realized Price Bands model.

Throughout this bull cycle, the lower band has played the role of a buy zone, with traders absorbing selling pressure and incurring losses. However, with Bitcoin currently falling below both this on-chain band and the 365-day MA—levels that have traditionally signaled changes in market momentum – the potential for a broader downside phase is heightened.

A failure to recover the lower band swiftly near $100K would initiate a deeper correction toward the $72K support zone in the next 1-2 months.

The bottom line is to get the $100K-$102k support, or we are back to breaking down the long-term bullish structure.

Bitcoin Price Fake Breakdown From Key Support Signals Reversal Ahead

On November 4th, the Bitcoin price witnessed a sharp sell-off and breached below the support trendline of an expanding ending channel pattern at $102,300. Since mid-July 2025, the BTC price was actively resonating between the two diverging trendlines of the pattern, which acted as a dynamic resistance and support for crypto-traders.

The formation of this pattern theoretically signals increasing market uncertainty, leading to a bearish breakdown for further correction. However, with today’s price jump of over 2%, the BTC price re-enters the Megaphone channel and currently trades at $103,691.

This fake breakdown could bolster buyers to counterattack and sustain its position above this high of interest around $100,000.

However, the Bitcoin price must breach Tuesday’s candle high of $107,165 to bolster its bullish reversal.

Also Read: Starbucks to Sell Majority Control of China Business to Boyu Capital in Growth Push