Ethereum Price Holds $4,000 Support as Sharks Accumulate

- The Ethereum price forms a three-top reversal pattern at $4,800 level in the daily chart.

- The daily RSI slopes down to 38%, reflecting the strong bearish hold on the current price trajectory.

- On-chain data indicates a shift in Ethereum’s top holders’ supply as shark addresses continue to accumulate, while whale numbers decrease.

On Wednesday, September 24th, the cryptocurrency market witnessed a slowdown in its correction momentum as the pioneer cryptocurrency Bitcoin rebounded above the $113,000 mark. Amid the relief rally, a majority of major cryptocurrencies, including ETH, managed to hold key support levels. As the Ethereum price is positioned above a pivot floor, a notable supply shift in supply dominance signals a dynamic move ahead.

ETH Sharks Lead Accumulation as Whales Step Back

By press time, the Ethereum price was trading at $4,161, displaying a short-bodied red candle with an insignificant loss of 0.09%. However, this daily candle shows a long rejection tail at the $4,000 floor, signaling the presence of demand pressure.

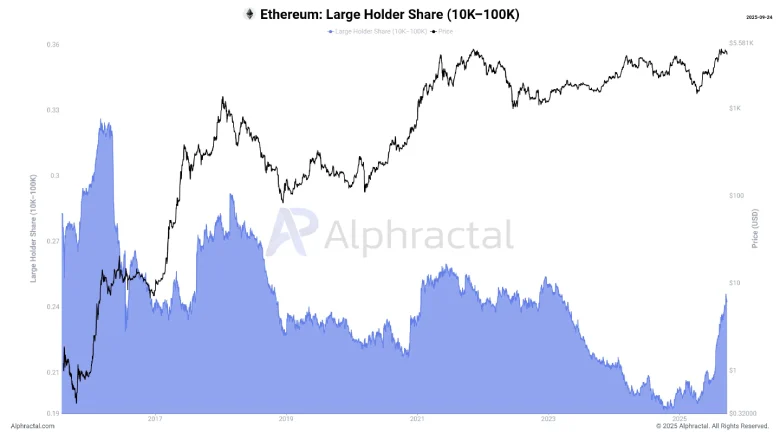

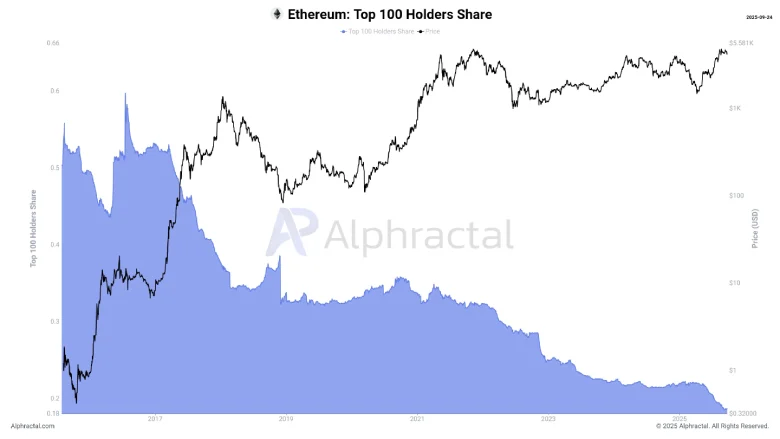

In a recent tweet, Joao Wedson, founder of the Alphractal analytics platform, highlights a shift in Ethereum’s supply concentration in the top holders landscape. However, data shows that addresses holding between 10,000 and 100,000 ETH, commonly referred to as “sharks,” are growing their representation in the circulating supply. On the other hand, the number of old-fashioned whales (institutional funds, exchanges and former miners) as the largest holders has been gradually dropping.

This shift in distribution is also mirrored in the Gini coefficient, a measure of wealth inequality, in the network. After a period of decreasing, the coefficient has started to increase again, and it looks like Ethereum holdings are becoming more centralized in the hands of richer, but not very large, addresses. The increasing power of these medium-sized investors suggests a market where buildup is taking place at a level below the traditional whale tier.

Large holders that typically engage in heavy selling activity are showing signs of distribution from long-term accumulation. These entities have often liquidated positions to newer participants in the market, and mid-sized investors have been taking advantage of market dips to build their position. As a result, there is a slight accumulation of power in the network, shifting from a few giant accounts to more substantial but smaller actors.

Therefore, the activity of sharks slowly changes the concentration of ETH on the network. Smaller holders still continue to accumulate, but it’s now the mid-cap bracket that is leading the charge. The accumulation by sharks leans bullish for the Ethereum price in the short term, but momentum could struggle as whales restrain.

Ethereum Price Correction Halts A Major Breakdown Floor

In the past two weeks, the Ethereum price fell from $4,768 to the current trading price of $4,160, accounting for a 12.65% loss. The daily chart highlights this as the third reversal in price since August 2025, suggesting an overhead supply pressure at above $4,800.

Such a three tops reversal pattern is often spotted at the peak of an uptrend, bolstering a bearish shift in coin price. The momentum indicator, Relative Strength Index, accentuates the mounting bearish momentum in price, as the RSI slope shows a steady downtrend before diving below the 40% threshold.

The Ethereum price correction has currently stalled its downward force at the $4,000 psychological level. If the sellers flip this support into potential resistance, the selling pressure could escalate and drive a prolonged correction towards $3,353.

On the contrary, if buyers managed to defend the $4,000 floor, the Ethereum price could enter a sideways action in an attempt to recuperate the exhausted bullish momentum.

Also Read: US Senator Calls for Probe into Trump Family’s Cryptocurrency Deals