World Liberty Financial Blacklists Justin Sun’s Address

Key Highlights

- World Liberty Financial blacklists Justin Sun’s address after he moved $9 million worth of WLFI tokens

- His address currently holds billions of WLFI tokens

- Justin Sun denies the allegation of wash trading and suppressing the token’s value

In a shocking event, U.S. President Donald Trump’s cryptocurrency venture, World Liberty Financial, has blacklisted Tron’s founder, Justin Sun’s address for reportedly transferring $9 million worth of WLFI tokens.

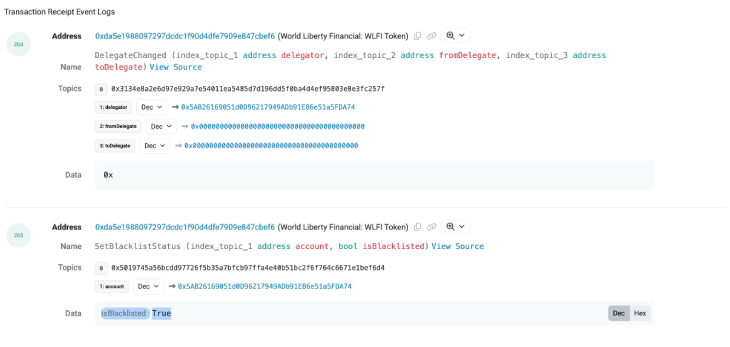

(Source: Etherscan)

It means World Liberty Financial froze Justin Sun’s wallet with 540 million unlocked WLFI tokens and 2.4 billion locked tokens. There is buzz in the community that his exchange, HTX, was using user tokens to sell and suppress the WLFI token price.

This blacklisting comes shortly after the token began public trading on major exchanges on September 1, 2025. Here, note that Justin Sun is World Liberty Financial’s largest outside investor with a $75 million investment. After that, he accumulated around 3 billion WLFI tokens.

According to the on-chain data, World Liberty Financial’s controlling address 0x407F…5178 invoked the guardianSetBlacklistStatus function on the WLFI Token contract to blacklist the address 0x5AB2…DA74, which is associated with Justin Sun.

Despite Sun’s earlier public claim that he had no intention to sell his unlocked tokens, it seems like Trump’s crypto venture might have suspected possible market manipulation by Justin Sun.

However, there is also buzz in the market that Justin Sun’s history of suspicious dealings could also be a possible reason for this blacklisting. This includes allegations of wash trading and securities fraud by the SEC.

However, Justin Sun has also responded to this rumor, stating on X that “Our address only conducted a few generic exchange deposit tests, with very low amounts, and then created address dispersion, without involving any buying or selling, which could not possibly have any impact on the market.”

Trump’s Chinese Partner in His Crypto Project

Earlier, Justin Sun praised U.S. President Donald Trump for embracing the cryptocurrency sector. However, his investment in WLFI has raised many questions about his relationship with Trump.

He is also endorsing crypto innovation in his homeland, China.

“I am optimistic about Hong Kong’s role in crypto over the long run. I don’t think Hong Kong authorities have much choice. By positioning itself as a financial centre, the city can’t avoid embracing crypto,” he said. “The trend of technology will not change. It is just a matter of time for China to embrace cryptocurrencies.”

“The speed of the process is up to regulators,” Justin Sun said. “As crypto industry players, we have to continuously showcase our successful experiences to convince the regulators.”

“Like the safety concern over space flight, if 100 successful experiments are not enough, we can go 500 times, 1,000 times and 10,000 times. There will be a final threshold,” he affirmed.

Trump Family Earns Billions from WLFI Sale

Trump’s fortune surged on Monday after His family’s crypto venture began trading. Billions were added on paper. The token is called $WLFI. It is from World Liberty Financial. The Trump family launched it last year. The price fell on its first trading day.

Despite the drop, the token’s market value neared $7 billion. This instantly made it a hot cryptocurrency. It also added an estimated $5 billion to the Trump family’s wealth.

Major exchanges like Binance and OKX list the token. Over $1 billion worth was traded in the first hour.

The Trump family has already profited. Reuters estimates they have made $500 million since the project’s launch.

Donald Trump is referred to as a “co-founder emeritus” on the site. He holds an unspecified number of tokens. He cannot sell them yet. Neither can his sons.

The tokens were not initially for trading. They gave holders voting rights. The Trump name drew early investors. They bet his backing would boost the value.

Making them tradable now allows open speculation. It fuels wider investor interest. It also generates fees for the exchanges.

Critics call the move a “roadmap for corruption.” They point to Trump’s pro-crypto policies while president.

The token’s value remains highly volatile. Its future is tied to the Trump name and market speculation.