Institutional Investors Drive Ethereum Amid Spot ETFs

- An ascending support trendline drives the prevailing recovery trendline in the Ethereum price.

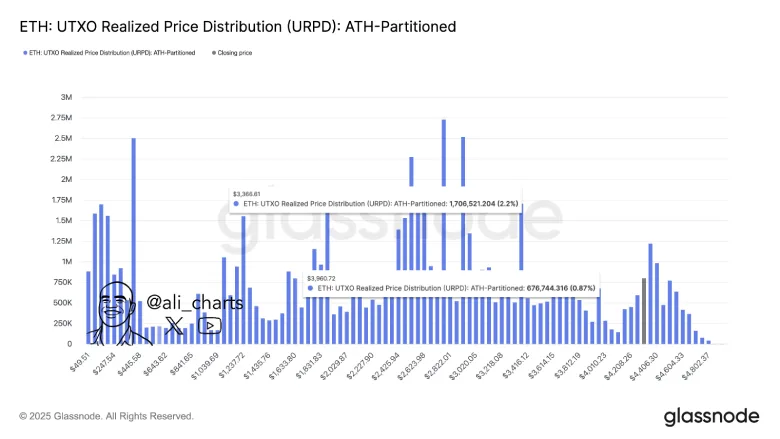

- On-chain data highlights Ethereum’s supply concentration at $3,960 and $3,366, creating a potential support zone in the current correction.

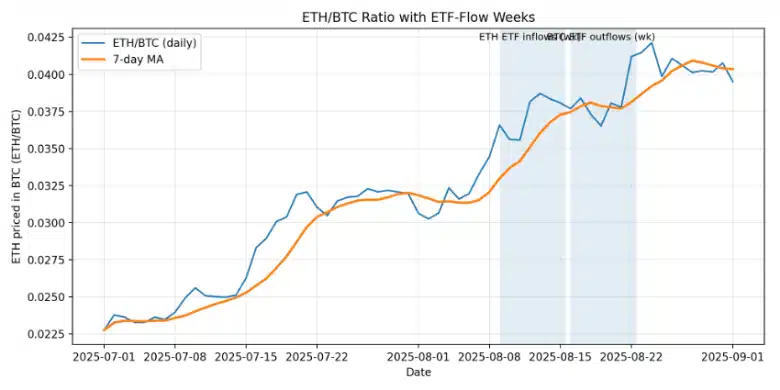

- The spot Ethereum ETFs saw a substantial inflow of approximately $4 billion in August, continuing their growth trend in 2025.

- The ETH price is positioned above the 50% Fibonacci retracement level, indicating a healthy pullback in action to regain bullish momentum.

Ethereum, the second-largest cryptocurrency, shows a slight uptick of 0.09% on September 7th. The neutral candle formation signals the continuation of market uncertainty and no aggressive participation from buyers or sellers. However, with the coin price holding above the key support zone, the sideways action could recuperate the exhausted bullish momentum. A steady inflow from U.S.-based Ethereum ETFs further reinforces the bullish momentum. Can the Ethereum price reclaim $4,500?

Ethereum Funds Draw Nearly $4B in August While Bitcoin ETFs Fall

Institutional investors have shown a significant deviation in their activities in the top two cryptocurrency funds in August. Statistics indicated that U.S. spot Bitcoin exchange-traded funds witnessed large withdrawals, amounting to about $751 million during the month.

Conversely, the Ethereum ETFs had a massive inflow of investments of approximately $4 billion in the same month. The continued patterns of flows, up until the end of August, point to a strong institutional shift in favor of Ethereum in the context of institutional allocation choices.

Market observers note that the persistence of Ethereum’s popularity could be due to the increase in confidence in the potential of the network and the overall trends of its adoption.

The price movement of Ethereum is now observed to be in the key support areas, and on-chain data show major investor activity. At $3,960, approximately 676,744 ETH, which is 0.87% of the circulating supply, is still held long-term.

The following important backing at $3,366 has an even greater share, namely 1,706,521 ETH, which is 2.2% of the supply. Such concentrations can be used as reference points in market activity, whereby buying or selling pressure may be heightened.

Therefore, a potential drop to this floor could bolster the falling Ethereum price with sufficient support for a reversal.

Key Support For Ethereum Price in Current Correction

Over the last two weeks, the Ethereum price witnessed a brief correction from $4,955 to $4,270, registering a 13.8% loss. The pullback likely followed the broader market correction amid the uncertainty around the September interest rate cut from the Federal Reserve.

However, the falling price is backed by a declining trendline in trading volume, signaling a weak conviction from market participants for a downward move. The ongoing correction takes a halt at an ascending support trendline at $4,140, currently positioned above the 23.6% Fibonacci retracement level.

Since late June, the bullish trendline has acted as a dynamic support for the Ethereum price, bolstering buyers to recuperate the exhausted bullish momentum after a short pullback.

Supporting the bullish narrative, the coin price holding above the 23.6% Fibonacci Retracement level is considered a healthy correction move in an established uptrend. In addition, the intact incline slope in the 50-100-200-day exponential moving average indicates the broader market sentiment is bullish.

A potential upswing must breach the immediate resistance of $4,517 before aiming for a new high of $5,000.

On the contrary note, if the price breaks below the ascending trendline, the selling pressure would accelerate and drive a prolonged correction.

Also Read: Kazakhstan Makes History With First Solana ETF with Staking