Chainlink Price Poised for Breakout as Whales, Institutions Buy

- The formation of a pennant pattern drives a short-term consolidation trend in Chainlink price.

- Caliber bought $6.5 million worth of LINK tokens for its treasury reserve, while the Chainlink reserve reported a buyback of 43,000 tokens.

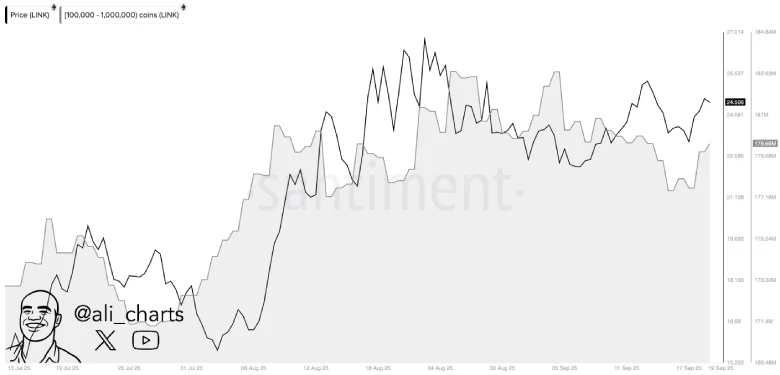

- Crypto Analyst highlights that crypto whales have bought over 2 million LINK tokens in the last 48 hours.

Oracle network Chainlink’s (LINK) native token dumped over 4.7% during Friday’s market hours to reach the $23.4 mark. The selling pressure likely came from investor disappointment as Wednesday’s Fed rate cut decision failed to drive the anticipated rally in the broader crypto market. Today’s downtick in Chainlink price signals the continuation of its short-term consolidation trend within the formation of a bullish pennant pattern. Along with the technical outlook, the LINK token gains additional momentum from rising corporate adoption.

LINK Rises as Caliber & Reserve Make Multi-Million Token Buys

In the first half of September, the Chainlink price witnessed a notable recovery from $21.87 to $25.64. The 17.24% advance came as the anticipation of monetary policy easing coincided with the growing institutional activity surrounding the asset.

On September 18, Caliber announced that it had completed a buyout of LINK at $6.5 million. The Arizona company operating in real estate and digital asset management said the transaction consisted of 278,011 tokens with an average acquisition price of $23.38 per token (including fees and costs). According to the press release, this represents the initial large-scale addition to Caliber as part of its Digital Asset Treasury program and increases its total LINK holdings to 6.7 million. The company stated that it used its current shelf registration, cash reserves, and equity-based securities to finance the acquisition.

This action was accompanied by an equivalent measure of the Chainlink Reserve that reported another purchase of 43,000 tokens on the same day. The transaction of $1.05 million represents a step toward achieving the goal of returning revenue generated through protocol integrations to LINK, akin to corporate stock buybacks. Recent data indicate that since August, the reserve has accumulated 323,116 total tokens, reaching a market value of $7.9 million.

In addition, the large investors show renewed interest in this asset. Crypto market analyst Ali Martinez highlighted the recent accumulation of over 2 million Chainlink tokens within the last 48 hours. The remark contributes to the story of focused demand that occurs when price momentum is in the process of accumulation.

The sequence of acquisitions highlights the interplay between corporate treasury plans, protocol-based reserve measures, and whale acquisitions, which significantly influenced LINK’s market dynamics in September.

Chainlink Price Coiling for a Major Breakout

Over the past six weeks, the Chainlink price showcased a short consolidation trend, resonating within the two converging trendlines of a bullish pennant pattern. Theoretically, the chart’s setup is characterized by a long ascending trendline, which denotes the dominating force in price, followed by a temporary pullback to replenish its exhausted bullish momentum.

With today’s downtick, the Chainlink price reached $23.45 trading value and continues its sideways momentum within the triangle structure. The momentum indicator RSI dropped to 49.84%, further accentuating the neutral market sentiment.

Also Read: MetaMask to Introduce In-Wallet Perpetuals Trading Feature

If the bearish momentum persists, the coin price could plunge 3.58% and retest the bottom support at $22.6. The recent history of this pattern indicates that a retest of the bottom trendline has intensified the buying pressure for a bullish upswing toward the overhead trendline.

Historical trends show that retests of the lower trendline have consistently fueled buying momentum, often triggering a bullish move toward the upper boundary.

Thus, the Chainlink price shows higher potential for a bullish breakout from the pennant pattern and signals the continuation of the prevailing recovery.

Related Cryptocurrency Market News