Aster Price Eyes $2 Recovery as Bull Flag Breakout Signals Upside

- Aster price gained its early adoption from celebrity endorsements, including Changpeng Zhao and MrBeast.

- A bull-flag pattern drives the short-term correction in the Aster price.

- Aster coin faces backlash over its ownership structure, as some analysts highlight that six wallets collectively control nearly 96% of the total supply.

Aster (ASTER), the native token of the decentralized perpetual exchange Aster, has been at the center of a growing controversy since its launch. From its recent listing surge, endorsement from famous personalities, and remarks on manipulation and centralization, the token’s price has become significantly volatile. Will the uncertainty push the Aster price below $1, or is a recovery to the $2 mark possible?

Aster Token Price Volatility Sparks Debate Over Centralization

ASTER price recorded one of the most dramatic early rallies of the year following its debut on September 17. The token shot out of the opening price of approximately $0.02 and reached a value of $2 in less than a week, an increase of approximately 9,900 percent, which caused a temporary valuation of approximately $3.3 billion.

The project enters the dense market of decentralized finance but differentiates itself by providing traders with unusually aggressive tools. It’s trading offers not just spot markets but also perpetuals at a leverage of over 1000x, a form of trading more prevalent in offshore derivatives markets than on on-chain exchanges. Adding to the appeal, ASTER holders are eligible for a 5% discount on trading fees, enhancing the token’s utility and incentivizing long-term holding.

A large portion of the spotlight followed celebrity endorsements. The former chief executive of Binance, Changpeng Zhao, applauded the initial early performance of Aster, and YouTuber MrBeast was said to have bought more than $100,000 of the token soon after it was launched. Blockchain monitor Lookonchain subsequently monitored wallet transactions,, which were purportedly associated with the influencer, implying a gain of more than $23 million through opportunistic selling. The arguments were quick to provoke controversy on whether advertising voices were cashing in on the retail euphoria.

Criticism has not been confined to celebrity involvement. Market observers have raised structural issues that do not sit well with Aster branding itself as a decentralized exchange. Trader Cyclop, who is also an angel investor, referred to the token as the largest market manipulation, citing the fact that six wallets represent approximately 96 percent of the circulating supply. This type of concentration of control makes it possible that any concerted action by such holders would trigger the price swing in an ugly manner.

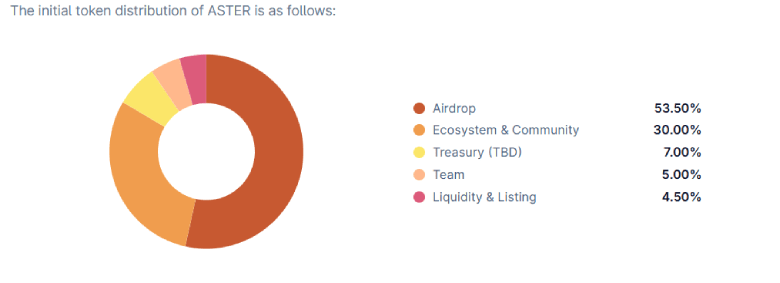

However, the reported breakdown of Aster’s tokenomics shows otherwise. According to Coingecko, around 53.5% of the token supply is dedicated to airdrops, and the remaining 30% of the tokens is assigned to ecosystem programs and community rewards. Liquidity pools, treasury operations, and the founding group have smaller tranches. Such allocations indicate the desire to drive ownership out, but critics claim that to date, the concentration of wallets wins over those goals.

To date, the cryptocurrency community remains divided. Some consider it a bright innovation in the field of decentralized finance, while others warn about the possible dangers of its rapid circulation and surrounding rumors, suggesting that price volatility could resume.

Also Read: DeFi Dev Corp. Launches First Korean Solana Treasury

Aster Price Exits Bull Flag Pattern

Over the past 48 hours, the Water price witnessed a brief pullback from $1.995 to $1.27, accounting for a 36% loss. Interestingly, the correction resonated strictly within two converging trend lines, indicating the formation of a bull flag.

The chart setup is characterized by a long pole reflecting a dominant trend in price, followed by a correction to recuperate the exhausted bullish momentum. The correction price rebounded quickly and offered a bullish breakout from the pattern resistance trendline near $1.54.

If the breakout holds, the ASTER price could jump 25% to reclaim the $2 mark, while an extended rally could chase it to $2.75.

Also Read: Chainlink Price Eyes Breakout as Whales and Institutions Accelerate Buying