Bitcoin Price Approaches Make-or-Break Support as Leverage Eases

- The Bitcoin price correction is poised to test a major pivot level of $110,000 amid the channel pattern formation.

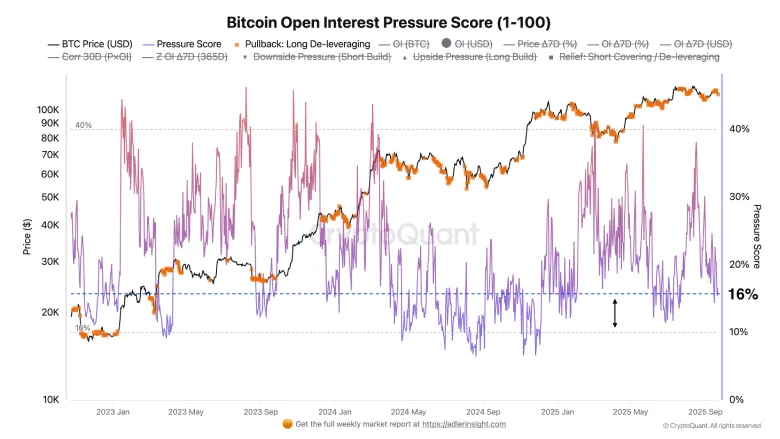

- BTC’s open interest pressure has eased to 16%, reflecting a light leverage environment following the recent wave of long liquidations.

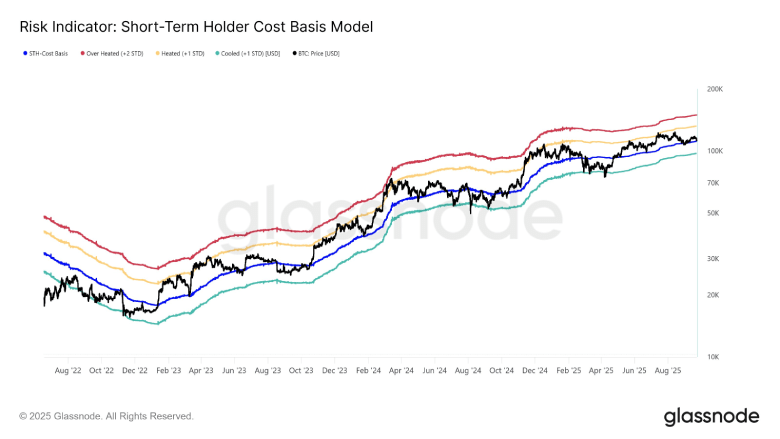

- The short-term holder cost basis metric highlights that the $111,400 level stands as the key battle line between bulls and bears.

The pioneer cryptocurrency, Bitcoin, began its new week on a bearish note, breaching the $112,000 floor during Tuesday’s market session. The price correction is scaling its momentum from the liquidation of long leveraged positions and the decline in future contracts tied to this asset. As market investors fear a correction ahead, the below-mentioned support could act as a major pivot level for the Bitcoin price to regain control.

Bitcoin Reverses Drained Leverage Bets from Futures Market

Last Friday, the Bitcoin price witnessed a bearish reversal from the $118,000 resistance, creating a fresh lower high formation in the daily chart. This swing indicates an emerging sentiment of sell-the-bounce among traders, which is commonly spotted in an established downtrend.

Although the retracement was central to attention, the derivatives market is reflecting a more relaxed scene than it was earlier in the year. The open interest pressure has dropped to 16%, according to data provided by Axel Adler Jr. of CryptoQuant. That number is below the 25% mark, most commonly adopted as a neutral range and way below the 40% mark, which indicates high risk.

Recent reading indicates that leverage is worn out following previous long liquidations, and price action has become less susceptible to unexpected wipeouts. The activity in the futures market is no longer considered a primary factor in intraday movements, with participation in the spot market becoming increasingly significant.

These low-leverage periods tend to form range-trading markets. The truth of that depends on which side starts to regenerate exposure. Heavy long bias around major levels of resistance may rekindle the likelihood of another deleveraging sell-off. In comparison, when short sellers are in charge of minor pullbacks, the arrangement may favor short-covering rallies that move the price up.

Glassnode reports that the short-term holder cost basis is a significant reference level during this stage. The current metric, which stands at approximately $111,400, serves as a positioning divide. Optimism is more likely to prevail when the spot prices are above it, although persistent movement below it has been associated with more established bearish structures.

At this point, the market is balanced by these forces, and the range of $111,000-$110,000 can be considered an important area of support.

Bitcoin Price Is Nearing Major Channel Support

Since May 2025, the Bitcoin price has witnessed a sustained uptrend amid the formation of a rising channel pattern. The two parallel trendlines of the pattern have acted as dynamic resistance and support to the BTC price, as evidenced by the three to four reversals from either boundary.

With today’s downturn, the BTC price is less than 2% short of retesting the bottom trendline at $110,400. The recent history of this pattern showcased that the bottom trendline provides a major accumulation zone for buyers, with the previous reversal triggering a 20-25% price recovery.

Thus, the presence of potential buying pressure at $110,000, via lower price rejection in daily candles, could signal that the mid-term trend remains bullish. That said, the bulls must breach the overhead resistance of $118,000 to restore their prevailing recovery momentum.

On the contrary, a breakdown below the support trendline would accelerate the selling momentum, driving a deeper correction.

Also Read: FTX Bankruptcy Trust Files $1.15B Lawsuit Against Genesis