Bitcoin Sentiment Turns Greedy as Traders Bet on 25bps Cut

- Bitcoin price recovery is poised for a bullish breakout from $117,400 resistance amid the FOMC meeting.

- Bitcoin sentiment across social platforms turned strongly bullish as FedWatchTool shows 96% odds of a rate cut.

- A bullish crossover between the 20- and 50-day exponential moving averages reinforces the bullish sentiment in the market.

On Tuesday, September 16th, the pioneer cryptocurrency Bitcoin jumped nearly 1.35% to reach the $116,949 trading price. The buying pressure can be attributed to market optimism toward an anticipated 25% interest rate cut as the FOMC meeting in the US kicks off today. The intraday jump bolsters the Bitcoin price for a bullish breakout from key resistance at $117,350, suggesting the next leap could lead to a new high.

Bitcoin Sentiment Peaks as FedWatch Shows 96% Odds of Rate Cut

The Federal Open Market Committee (FOMC) in the United States starts its two-day meeting today, and markets are eyeing the decision that will be taken tomorrow. Current market consensus is for a 25 basis point cut in interest rates, an outcome that traders have priced in for months.

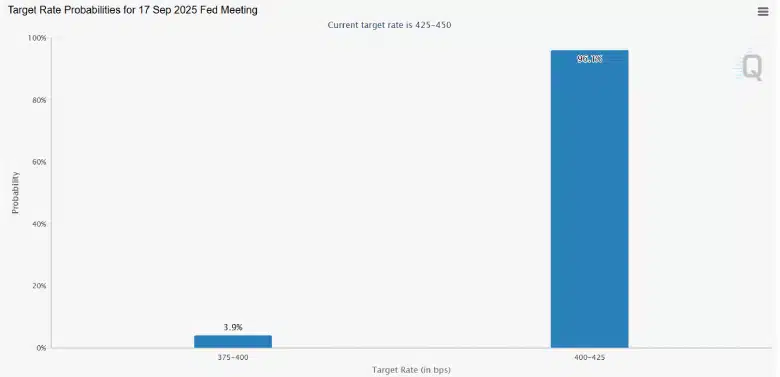

According to the CME FedWatch Tool, the probability of a 25 basis point cut from policymakers is 96%. while only a small 4% probability is attached to a deeper 50 basis point move that would reduce the target band to 375-400.

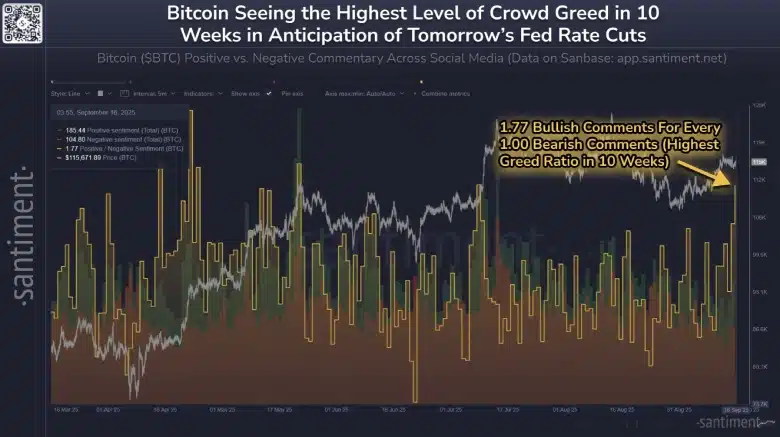

The excitement surrounding the policy shift has already spread into the crypto industry. As per the data from Santiment, the Bitcoin-related discussions on social platforms have shifted to a very bullish direction. According to the analytics company, “Social media comments are bullish to bearish at a ratio of 64%, with more bullish comments than bearish.” The ratio, they point out, is “the greatest extent of crowd greed since July 10th.”

However, such optimism can be a cause for market skepticism in the short term. As Santiment notes, “Historically, markets tend to trend in the opposite direction of retailers’ expectations.” The analytics platform explains that it is not necessarily indicative of a Bitcoin or altcoin bear market but that “expectations should be tempered by a huge surge after the rate cuts are confirmed tomorrow.”

Analysts also warned of a potentially more significant reaction should the outcome be different from the consensus. If there is a sudden change of opinion and rates are not cut, a rapid correction could occur, which would not be expected by retailers.

Bitcoin Price Challenges Key Resistance Ahead of Fed Decision

In the last two weeks, the Bitcoin price rebounded with a V-shaped recovery from $107,300 to a current trading price of $116,974, accounting for a 9% gain. The buying pressure can be attributed to the U.S. macroeconomic development, increasing ETF inflow, and institutional adoption, bolstering the BTC price to restore 50% of the loss witnessed during the August correction.

The rising coin price managed to reclaim the fast-moving exponential moving averages (20 and 50) while also triggering a bullish crossover between them to further reinforce the bullish market sentiment.

Ahead of the Fed decision, the Bitcoin price is pushing against the overhead resistance of $117,350. If the coin price breaks through this resistance and turns it into potential support, buyers could strengthen their grip on the asset, potentially retesting the all-time high resistance at $123,730.

On the contrary, if interest rates are not cut, the Bitcoin price could face a sharp rejection from the $117,350 barrier and create a new lower high formation in the daily chart for continued correction.

Also Read: Forward Industries Buys 6.82 SOL as Solana Price Closes to Key Support