Ethereum Price Eyes $5,000 Jump With This Breakout

- Ethereum price gives a decisive breakout from the resistance trendline of the flag pattern.

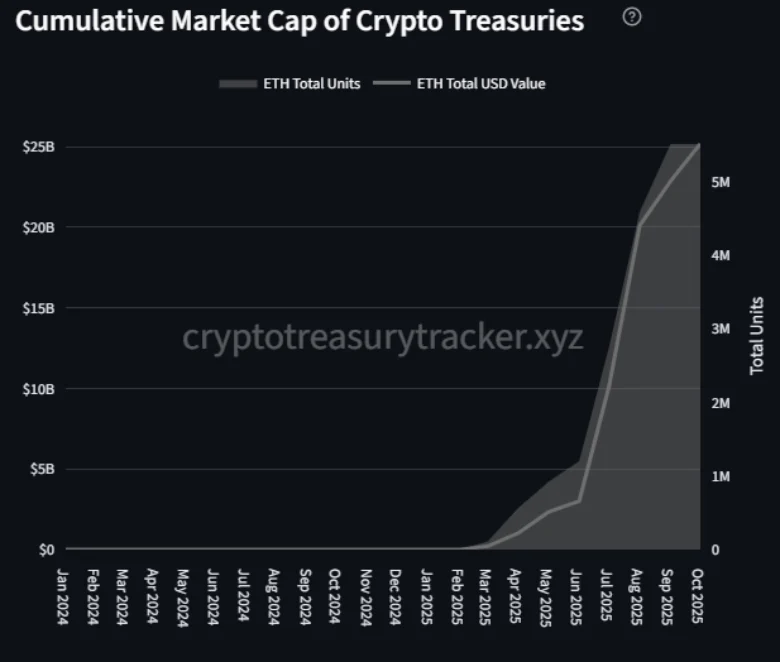

- Sentora analytics reports Ethereum’s treasury-held value has now crossed $25 billion.

- ETH’s fear and greed at 57% accentuates a bullish sentiment among crypto investors.

The first week of October has been strongly bullish for the crypto market. While the pioneer cryptocurrency, Bitcoin, hit a new high of $126,270, the Ethereum price reached $4,681. Along with general bullish sentiment, the demand pressure for ETH can be attributed to rising corporate adoption, whale buying, and ETF inflow. Will the uptrend continue for a new high?

Ethereum Treasury Value Surges Amid Renewed Uptober Momentum

Ethereum, the next second-largest cryptocurrency by market cap, jumps 3.8% on Monday to trade at $4,700. This aligns with a wider trend in crypto markets commonly known as Uptober due to seasonally positive trader sentiment.

Recent on-chain records show that big investors have been steadily increasing their Ethereum holdings by direct acquisition as well as exchange withdrawals. A wallet with the address 0xd65F sent the USDC value of $33 million to the Hyperliquid exchange and exchanged it with approximately 7,311 ETH at an average price of $4,514 per token.

A separate large transaction, 0xa312, withdrew approximately 8,695 ETH, worth approximately $39.5 million, out of Binance, indicating long-term storage or potential redirection of funds. Moreover, the former CEO of BitMex crypto exchange, Arthur Hayes, bought another 113.7 ETH, amounting to about $520,000, in the last couple of hours.

Data from blockchain analytics company Sentora points to a wider institutional trend behind such movements. Corporate and institutional treasury holdings of Ethereum have now topped 25 billion, a number that has increased dramatically since the beginning of the year.

The data visualized by the Crypto Treasury Tracker shows that the total number of units of ETH in treasuries has increased to over 5 million, and the value of this number is growing faster than the price increments during the last quarter of 2025.

The most recent accumulation wave of large holders and the accelerating growth of ETH-based treasuries reinforce the continued significance of Ethereum in the digital asset world as players in the market increasingly align themselves with expected network and market trends through persevering on-chain accumulation.

Also Read: Plume Wins SEC Nod as Transfer Agent for Tokenized Assets

Ethereum Price Breaks Out of Flag Pattern

In the last two weeks, the Ethereum price has shown a steady rally from $3,822 to the current trading price of $4,686, accounting for 22.67%. Consequently, the assets market cap jumped to $5.52 billion.

A look at the daily chart shows that this rally gave a decisive breakout from the resistance trendline of a bull flag pattern. The chart setup is commonly spotted within an established uptrend, as it allows buyers to recoup the exhausted bullish momentum. T

Theoretically, the chart pattern shows a steep ascending trend line, reflecting the dominant trend in price, followed by a short temporary correction within two downsloping trendlines.

The latest breakout indicates a potential end to the recent correction phase, supported by a rebound in momentum as the RSI has surged past the 60% mark. With sustained buying, the post-breakout rally could surge another 16% to hit $5,425.

A bullish incline in exponential moving averages (20, 50, 100, 200) further accentuates the bullish sentiment in the market. These EMAs could act as occasional pullback support for ETH amid the anticipated rally.

On the contrary, if a potential recent Ethereum price breaks within the channel pattern, the bullish thesis would get invalidated.

Related Cryptocurrency Market News