JPMorgan Says Crypto Adoption Is Just Getting Started

Key Highlights

- JPMorgan Chase analyst says institutional adoption of cryptocurrency is still in its infancy

- Institutions currently hold approximately 25% of all Bitcoin exchange-traded products (ETPs)

- However, 71% of institutional investors surveyed in 2025 shared their skepticism about directly trading crypto

On September 10, global banking leader JPMorgan Chase announced that the institutional adoption of cryptocurrency is still in its “early phases.”

INTEL: JPMorgan says institutional adoption for crypto is still in early phases

— Solid Intel 📡 (@solidintel_x) September 10, 2025

This assessment comes even as the bank itself aggressively expands its own crypto projects. This shows the complex dance between caution and ambition happening on Wall Street.

Institutions Own 25% of Bitcoin ETPs, Says JPMorgan

The declaration was made in a recent report from the bank’s analysts. They revealed that while interest is rapidly growing, the actual integration of digital assets into the mainstream financial system is only beginning.

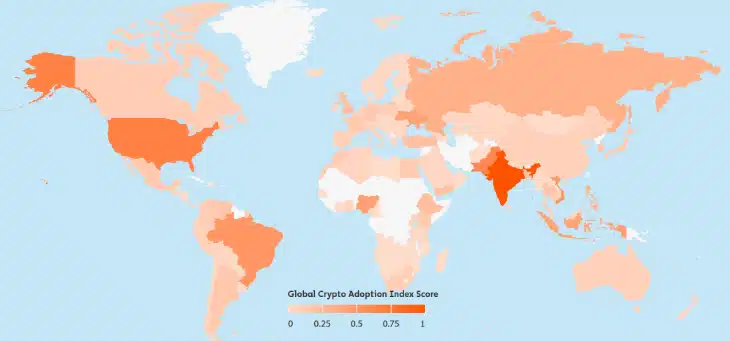

(Source: Chainalysis)

This nuanced view shows a major change in their stance that banks are no longer asking if they will engage with crypto, but how to do it safely and effectively.

The data present a compelling story. Institutions currently hold approximately 25% of all Bitcoin exchange-traded products (ETPs), with growing allocations to other major cryptocurrencies like Ethereum and Solana.

Perhaps more telling is a survey cited by the bank, which found that a staggering 85% of financial firms have either already invested in digital assets or plan to do so by the end of 2025.

This surge mainly comes from two key factors, which are clearer regulations and successful market entries. Laws like the GENIUS Act, which mandates that stablecoin reserves be held at FDIC-insured banks, are creating a safer environment for big money.

Furthermore, successful crypto-related IPOs are proving that legitimate, large-scale businesses can be built in this space. These positive developments are building confidence among traditionally risk-averse investors.

However, JPMorgan is quick to point out that major roadblocks remain. A substantial 71% of institutional investors surveyed in 2025 expressed hesitation to directly trade cryptocurrencies.

Their concerns are centered on three major issues, including fragmented global regulations, the technical risks hidden in smart contracts, and the stomach-churning volatility that the crypto market is known for.

What makes JPMorgan’s report so important is that the bank is not just an observer; it is an active participant leading the charge. The bank has made a huge step with JPM Coin, its own U.S. dollar-pegged stablecoin.

Designed for institutional use, it facilitates instant, 24/7 cross-border transactions. This stablecoin is directly challenging the slow and expensive traditional wire system.

In one of its most ambitious projects, JPMorgan is reportedly developing a crypto-collateralized lending program. This service, expected by 2026, would allow the bank’s wealthiest clients to use their Bitcoin or Ethereum as collateral to secure cash loans.

This move directly shows services offered in the decentralized finance (DeFi) world. Also, it would provide crucial liquidity to large holders without forcing them to sell their assets and potentially crash the market.

The initiative faces a major hurdle in the form of Basel III regulations, which impose a punishing 1,250% risk weighting on such loans, making them incredibly capital-intensive for the bank. JPMorgan is reportedly exploring partnerships and complex structuring to make the program feasible.

The bank’s evolving stance is perhaps best symbolized by its own investments. JPMorgan currently holds $1.7 billion in Bitcoin ETFs, a massive vote of confidence in these relatively new financial products. It also recently began allowing its wealth management clients to buy Bitcoin directly, a stark contrast to CEO Jamie Dimon’s past criticisms of the cryptocurrency.

According to some experts, the institutional adoption of crypto is inevitable, but it will be a gradual, carefully managed process. For instance, the Japanese investment firm Metaplanet has raised $1.4 billion to buy Bitcoin.

With cautious analysis and new innovations in the digital asset sector, the banking giant is not just preparing for the future of finance, but it is actively building it. Their actions prove that digital assets have moved from the fringe to a strategic imperative for the world’s largest financial institutions.