XRP Price Stalls $3 Breakout Amid ETF Delay

- XRP price rides a short-term correction amid the formation of a pennant pattern in the daily chart.

- XRP’s 60-day correlation with BTC remains high (0.82), amplifying downside during Bitcoin price weakness.

- Coinglass data shows $20.54 million in long liquidations as the XRP price dropped 4.45%.

XRP, the native cryptocurrency of the XRP ledger, recorded a 4.45% drop on Tuesday, October 7th. The pullback followed a sharp plunge in Bitcoin price below $125,000 and substantial long liquidation of futures traders. The latest on-chain data highlights rising FUD among retail traders as XRP loses its top-4 position to BNB, the native token of the BNB chain. Will the Ripple crypto fail to take advantage of Uptober sentiment?

XRP Lags Amid ETF Delays and Retail Fear Shape Outlook

The first week of Uptober managed to meet investor expectations as Bitcoin price rallied to new high of $125,270 on Monday. While a majority of major altcoins followed this momentum, the XRP price struggled to surpass the $3 psychological level.

Pro-crypto lawyer Bill Morgan cited the slower pace XRP moves compared to Bitcoin and Ethereum and the lack of an XRP spot ETF as a factor. According to Morgan, Bitcoin and Ethereum continue to have a market advantage from their spot ETF approvals, while the SEC is yet to act on similar applications for XRP and other altcoins. “How long can spot XRP ETFs continue to lag?” he questioned amid the increasing frustration of investors needing clarity.

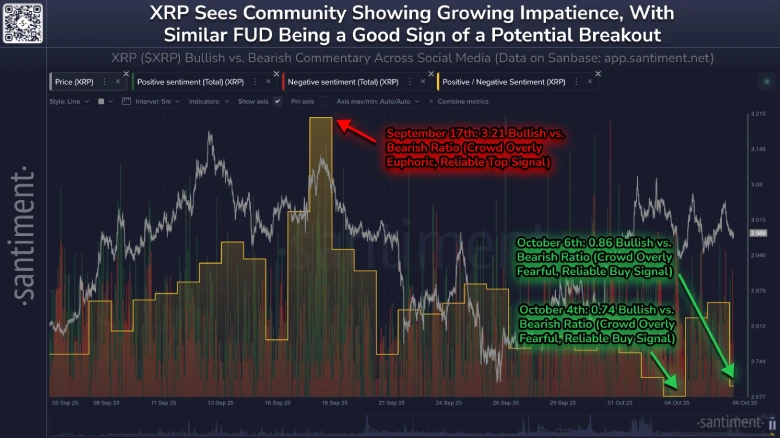

In addition, retail sentiment towards XRP has seen a stark change in recent days. The token is experiencing the highest levels of fear and uncertainty since the tariff-related market shocks six months ago among smaller traders. For two out of the last three sessions, bullish stories have given way to bearish stories—historically a contrarian sign that has preceded upward reversals.

Derivatives data draw a contrasting picture of increasing speculative interest. XRP futures open interest has bounced from $7.35 billion to $9.09 billion in the last two weeks, accounting for a 23% jump. This increase indicates that more traders are entering the market on speculation of future price movements.

With speculation around a potential Federal Reserve rate cut on October 29 and seven XRP ETF applications hitting SEC deadlines starting October 19, analysts point out how these converging catalysts could add volatility in the short term, creating conditions that could ultimately facilitate a potential rebound in XRP price.

XRP Price Coils Within Pennant Pattern

Since last week, the XRP price has shown a brief pullback from $3.09 to a current trading price of $2.86, accounting for a 7.42% loss. Interestingly, the pullback is positioned at the key resistance trendline of the bullish continuation pattern called “Pennant” in the daily chart.

Since mid-July 2025, the coin price has been actively resonating within the two converging trendlines of this pattern as they offer dynamic resistance and support to market participants. If the altcoin continues to face overhead supply, the price could plunge another 6.5% before retesting the bottom support at $2.67.

The recent history of the pattern shows that the lower trendline has acted as an active accumulation zone for buyers and a potential bullish rebound. If the buyers continue to defend this support, the consolidation trend will continue before a decisive breakout from either end.

A bullish breakout from the pattern’s overhead trendline would accelerate the recovery momentum and bolster the Ripple crypto to extend a rally above $3.

A sideways band in the Bollinger Band indicators accentuates the neutral sentiment in the near-term trend.

Also Read: Yen Slides to Two-Month Low Amid Japan Election Uncertainty