Bitcoin Price Targets $125,000 as Supply Squeeze Intensifies

- The Bitcoin price breakout from an inverted head and shoulder pattern signals a potential 7.2% surge to chase the $125,000 high.

- Bitcoin sharks accumulated over 65,000 BTC last week as retail investors’ hesitation signaled a supply shift from weak to strong hands in the market.

- A price recovery above the 20- and 50-day EMA slope signals renewed bullish sentiment in the market.

The pioneer cryptocurrency, Bitcoin, shows a 0.75% increase during Friday’s U.S. trading market hours to continue its bullish recovery above the $116,000 mark. This upswing came as a renewed recovery force after a brief correction in late August. However, the on-chain data shows that a combination of shark accumulation, LTH buying, and exchange outflows creates the setup for a supply squeeze in Bitcoin price, signaling a higher potential for a new high.

BTC On-Chain Signals Point to Shrinking Bitcoin Liquidity

Fresh blockchain numbers show a stark contrast between Bitcoin market dynamics, with the big hands increasingly driving up exposure while short-term traders stick to the sell side. Addresses that normally control between 100 and 1,000 BTC—called “sharks”—increased their holdings by 65,000 BTC in the last week, bringing their total stash to an all-time high of 3.65 million BTC.

The accumulation took place when Bitcoin prices were trading near $112,000, noting the willingness of mid-sized investors to absorb supply in spite of day-to-day fluctuations. This shift comes into focus by looking at two other datasets: long-term holder positioning and exchange balance movements.

CryptoQuant’s Long-Term Holder Net Position Change measure, which indicates the 30-day changes in wallets that aren’t normally used for long periods, has shifted significantly to the positive. Periods of high inflows to these wallets are typically accompanied by coins flowing into less liquid parts of the market, decreasing supply for trading. Current readings indicate that these long-term investors are in accumulation mode and not distribution.

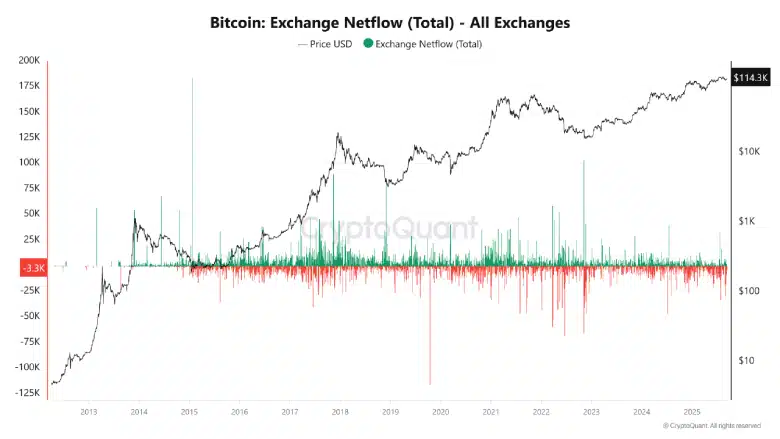

Exchange-related activity helps to tell the same story. NetFlow statistics show ongoing withdrawals from centralized trading platforms. More Bitcoin is leaving exchanges than is coming in, which suggests investors are moving assets into self-custody arrangements. Such flows lower the amount of available BTC for sale and trading, in contrast with the speculative turnover associated with, in particular, volatile price motions.

Together, these patterns—shark wallets adding to balances, long-term holders adding to positions, and diminishing exchange reserves—demonstrate the structural shift that is occurring under the hood of headline price moves. While it’s too early to tell where the immediate market direction will take us, based on the OnChain data, it appears that the long-term migration of coins away from liquid venues and into longer-term storage is underway.

Bitcoin Price Breakout From Reversal Pattern Aims For New High

On September 10th, the Bitcoin price gave a bullish breakout from $113,473 resistance after spending over two weeks consolidating below it. The sideways action, when looked at in the 4-hour time frame chart, shows the formation of a traditional reversal pattern called inverted head and shoulders.

The chart setup is commonly spotted at the end of a major downtrend, signalling the reversal of the recent BTC correction, which initiated in mid-August. According to the Fibonacci retracement level, this bullish upswing is positioned above the 38.2% Fib level, signaling that the Bitcoin price has witnessed a healthy correction to recuperate its exhausted bullish momentum.

Amid the ongoing recovery, the 20- and 50-day exponential moving averages started to incline, reinforcing the bullish sentiment in the market. Thus, with sustained buying, the BTC price is likely to reach the immediate resistance of $117,564 to prepare its leap of over 6.5%. just a new high above $125,000.

On the contrary, if the supply pressure at $124,000 resistance continues to persist, the BTC price could shift to a sideways trend in the short term to further recoup its bullish momentum.

Also Read: Dogecoin Price Rally Stalls As ETF Launch Delayed