Solana Active Addresses Plunge 60% — Could a Price Correction Be Next?

SOL, the native cryptocurrency of the Solana ecosystem, plunged 4.7% during Thursday’s U.S. market hours. The selling pressure aligns with a broader crypto market pullback as the U.S. government shutdown reached its 9th day, delaying key economic data and amplifying volatility. However, the Solana price faces additional headwinds as its on-chain data reflects a persistent downtrend in the number of active addresses. Was the recent surge in SOL coins driven by speculative forces?

- A rising channel pattern drives the mid-term uptrend in the Solana price.

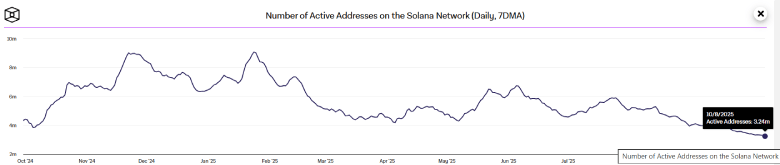

- Since late January 2025, the number of active addresses on the Solana network has dropped by roughly 65%, signaling a significant slowdown in user engagement and on-chain participation.

- A sharp rise in SOL futures OI and TVL indicates the ongoing rally is supported by liquidity and investor sentiment.

SOL Network Weakens Beneath the Surface as Price and TVL Surge

Solana’s network activity shows signs of strain despite its market price continuing to increase, indicating an increasing gap between user engagement and investor behavior. According to TheBlock data, Solana’s active addresses have witnessed a significant decline this year, falling from the last major peak of 9.02 million in late January to 3.24 million recorded this week.

This 64% decline in user participation has contrasted with the upward price movement of the asset, suggesting an imbalance between the fundamentals of the network and the market enthusiasm. The divergence suggests that Solana’s recent rally may be occurring against the backdrop of cooling on-chain activity.

Historically, price strength was normally accompanied by increased wallet interaction and network demand. However, the current pattern suggests that market participants may be reacting more to speculative cues than to underlying blockchain usage.

At the same time, data in the derivatives market represents increasing speculative exposure. Figures from Coinglass reveal that open interest in futures contracts associated with Solana has grown from about $3.65 million in March to almost $15 million, an increase of more than 300%. This jump notes an inflow of leveraged positioning, which could increase the volatility around the asset.

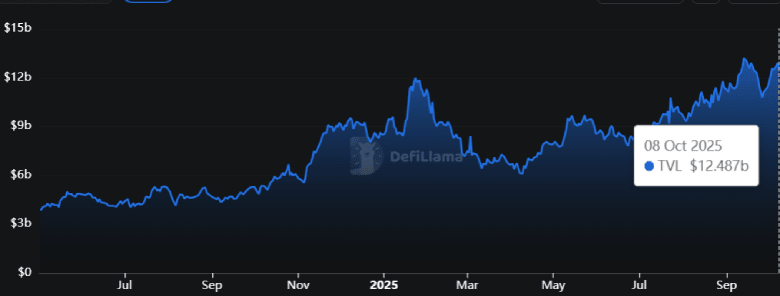

Despite the contraction in the number of active users, Solana’s decentralized finance (DeFi) landscape is showing signs of strong capital inflows. Total value locked (TVL) on the network has almost doubled from $6.1 billion in April to around $12.24 billion, according to DefiLlama.

The boom in futures activity and total value locked versus the declining base of active users implies that liquidity and investor sentiment are contributing to the current phase more than actual on-chain engagement. If this divergence continues, it could impact the sustainability of Solana’s price momentum and reshape the perception of network’s work strength in the coming months.

Solana Price Drives Recovery Within Channel Pattern

Over the past week, the Solana price has been hovering above $218, struggling to build sufficient momentum for the next leap. The sideways action aligned with broader market uncertainty amid the U.S. government shutdown and profit-taking from short-term holders.

If the overhead supply persists, the Solana price could breach $218 support and challenge the bottom support trendline of a rising channel pattern. Since late June 2025, the coin price has traveled a steady uptrend within the two ascending trendlines of the channel pattern, receiving dynamic support and resistance.

A history of this pattern shows that a retest through the bottom trendline has recuperated the exhausted bullish momentum in Solana price for substantial bullish upswings. However, if this support breaks, the selling pressure will escalate and drive a deeper correction in the coin price.

On the contrary, if the coin price managed to hold its channel support or $218 floor, the price recovery could extend higher and test the upward boundary around $290.

Also Read: Bitcoin Price Tests Make-or-Break Resistance at $125K