Bitcoin Price Eyes $117k Breakout as Fed Cuts Rates by 25 bps

- The U.S. central bank approved a quarter-point rate cut at the September policy meeting, marking its first easing in 2025.

- The Bitcoin price recovery challenges the $117,381 neckline resistance of a bullish reversal pattern called an inverted head and shoulders.

- A bullish crossover between the 20- and 50-day exponential moving averages reinforces bullish momentum in the current price recovery.

On Wednesday, Federal Reserve Chair Jerome Powell announced the US central bank’s decision to cut its key interest rate by 0.25%. The move aligns with the broader market’s anticipation and spurs bullish sentiment in the crypto market. As a result, the Bitcoin price managed to rebound from its intraday loss of $114,747 to a current trading price of $116,943, accounting for a 0.11% gain. Following the Fed decision, the BTC price still struggles at the neckline resistance of a reversal pattern, signaling a potential breakout in the near term.

Powell Announces First Fed Rate Cut of 2025

At the September FOMC meeting, the Federal Reserve reduced its target interest rate by 25 basis points, bringing the target range down to 4.00%-4.25%. This marks the first rate cut since December 2024 and aligns closely with market expectations.

The majority of Fed officials indicated that additional cuts might occur. Revised forecasts indicate that there will be two additional quarter-point reductions before the year ends, which could ensure the policy rate ends at 3.50-3.75%. Seven members reported that rates might not decline further after the present move, whereas two reported that they would decrease once more. Stephen Miran was the only dissenter who requested a more aggressive reduction in the rates by 50 basis points.

The decision was impacted by economic conditions. The growth in job creation has been sluggish, and there has been an increase in the unemployment rate, albeit at a low level. On the other hand, inflation remains above the Fed’s 2% long-term target. In its statement, the Committee pointed out that policy adjustments will still be informed by the changing data on the labor market and inflation.

The policy shift has already affected the U.S. lending rates. The announcement by the Fed saw major banks, such as JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America, lower their prime rates by half a point to 7.25%.

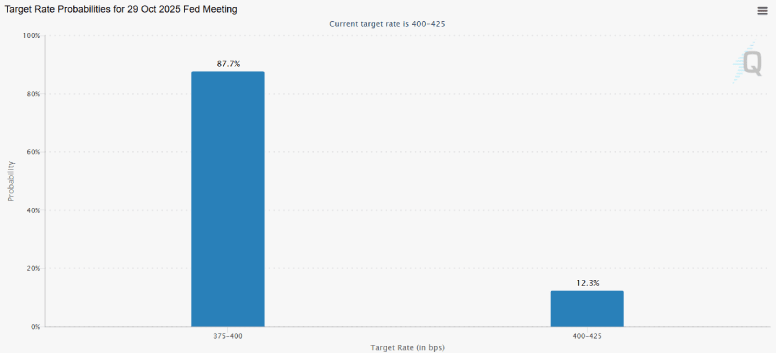

Market expectations are still inclined toward further easing. FedWatch data released by CME indicates an 87.8% likelihood of a further 25-basis-point cut at the next FOMC meeting in October, where the range would be 3.75%-4.00%.

Bitcoin Price Halts at Key Resistance of Reversal Pattern

Since last week, the Bitcoin price has showcased a sluggish sideways trend, ranging around $116,000. The consolidation created a short-bodied candle with a long wick on either side, indicating a lack of initiation from buyers or sellers.

Ahead of the FOMC decision, the Bitcoin price struggled to maintain bullish momentum and dropped to a low of $114,747. However, the 0.25% interest rate renewed the market buying pressure and pushed BTC to its current value of $116,970.

The daily chart analysis shows that this lateral trend holds the potential to develop a traditional reversal pattern called an inverted head and shoulders. The chart setup is consistent for three troughs: the middle head and two shallow shoulders on the sides, commonly spotted at the end of a downtrend.

If the pattern holds, the Bitcoin price will breach the $117,381 neckline resistance, signaling the end of the current correction. The post-breakout rally could push the price 6% up to the all-time high resistance of $124,517.

On the contrary, if the sellers continue to defend the $117,381 resistance, the daily chart could form a fresh lower-high formation before extending the downward trend.

Also Read: CleanCore Solutions Acquires 100M Dogecoin Worth $26.8M